The Finance Commission of India plays a pivotal role in shaping the financial architecture between the Union and the States, ensuring a balanced allocation of resources. On 31st December 2023, the 16th Finance Commission was inaugurated, marking the beginning of a new chapter in India’s fiscal federalism. Led by Shri Arvind Panagariya, a distinguished economist and former Vice-Chairman of NITI Aayog, the commission comprises four other eminent members tasked with evaluating and recommending the distribution of taxes between the central and state governments. Their work, deeply rooted in the principles outlined in Articles 280 and 281 of the Constitution of India, 1950, is crucial for maintaining fiscal stability and promoting the equitable development of all states.

Facts

Constitution of the 16th Finance Commission

The 16th Finance Commission was constituted on 31st December 2023, with Shri Arvind Panagariya, the former Vice-Chairman of NITI Aayog, appointed as its Chairman. This move is significant for Judiciary aspirants to note as it marks the beginning of a new fiscal evaluation period in India.

Role and Formation

Under Articles 280 and 281 of the Constitution of India, the President is mandated to constitute a Finance Commission every fifth year or sooner, if necessary. This Commission is pivotal in defining the financial relations between the central government and the states. It comprises a Chairman and four other members appointed by the President, a fact crucial for understanding the structure and functioning of this body.

Duties of the Commission

As per Article 280(3) of the Constitution, the Commission’s duties include recommendations on the distribution of tax proceeds between the Union and the States, principles for grants-in-aid, measures to augment the Consolidated Funds for Panchayats and Municipalities, and any other matters referred by the President. These points are essential for aspirants to grasp the breadth of responsibilities the Commission holds.

Qualifications for Membership

According to Article 280(2) and Section 3 of the Finance Commission (Miscellaneous Provisions) Act, 1951, members must have vast experience in public affairs, law, government finances, financial matters and administration, or economics. Understanding these qualifications can help aspirants appreciate the expertise brought to the Commission’s deliberations.

Powers and Procedures

The Finance Commission operates with the powers of a civil court under the Code of Civil Procedure, 1908, as per Section 8 of the Finance Commission (Miscellaneous Provisions) Act, 1951. This includes summoning witnesses, requiring documents, and requisitioning public records, highlighting the Commission’s extensive investigative capabilities.

Amendments Impacting the Commission

The 73rd and 74th Constitutional Amendments added duties to the Commission, focusing on augmenting the Consolidated Funds to support Panchayats and Municipalities. These amendments underscore the evolving scope of the Commission’s responsibilities, particularly in strengthening local governance.

Composition of the 16th Commission

Alongside Chairman Shri Arvind Panagariya, the Commission includes members Shri Ajay Narayan Jha, Smt. Annie George Mathew, Dr. Niranjan Rajadhyaksha, and Dr. Soumya Kanti Ghosh. Knowing the members helps aspirants identify the diverse expertise guiding the Commission’s recommendations.

Recommendation Timeline

The 16th Finance Commission’s recommendations are expected to cover the period following the 15th Commission’s tenure, which ends on 31st March 2026. This forward-looking timeline ensures continuity in fiscal planning and policy-making, a critical fact for those studying India’s financial governance system.

What is Finance Commission?

The Finance Commission, as outlined in Articles 280 and 281, serves as the cornerstone for fiscal federalism in India. Article 280(1) highlights the President’s role in constituting the Commission, which is composed of a Chairman and four other members. These provisions underscore the constitutional intent to ensure a systematic and fair distribution of financial resources between the Union and the states, thereby upholding the principle of cooperative federalism.

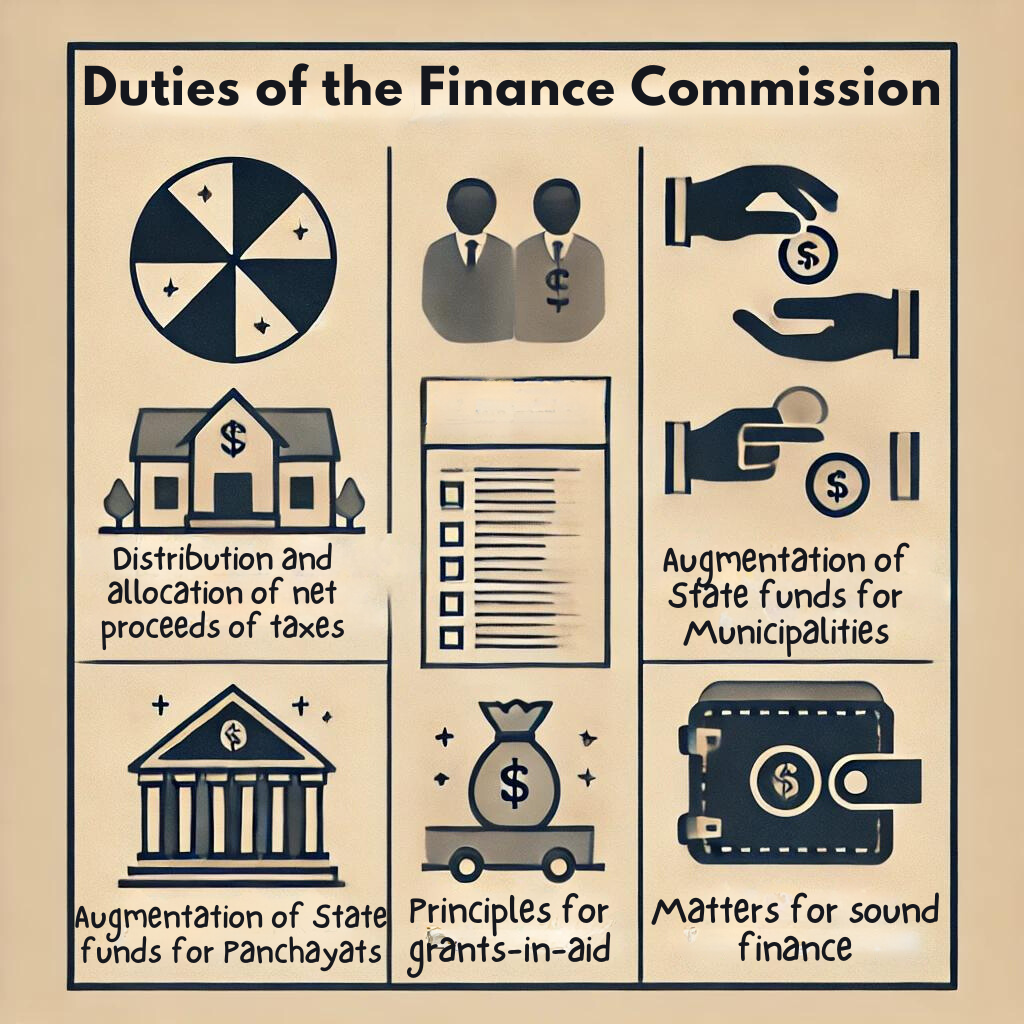

Duties of the Finance Commission

Distribution and allocation of net proceeds of taxes

The Finance Commission plays a critical role in determining the distribution of tax revenues between the Union and the States, as well as among the States themselves. This is crucial for maintaining a balanced economic structure across the country, ensuring that resources are allocated fairly and efficiently to foster regional development and equity.

Principles for grants-in-aid

Article 280(3) delineates the Commission’s duty to recommend principles governing the grants-in-aid of the state’s revenues from the Consolidated Fund of India. This ensures that states with financial disparities receive adequate support, maintaining an equitable standard of public services across the nation.

Augmentation of State funds for Panchayats

The Commission also recommends measures to augment the Consolidated Fund of a State, aiming to boost the financial resources available to Panchayats. This empowers local governments, enabling them to provide better services and infrastructure, thus strengthening grassroots democracy.

Augmentation of State funds for Municipalities

Similarly, the Finance Commission advises on enhancing State funds to support Municipalities. This initiative is pivotal for urban development, ensuring that cities and towns have the necessary funds for infrastructure, public services, and governance improvements.

Other matters for sound finance

The Finance Commission also addresses other financial matters referred by the President, playing an advisory role that covers a broad spectrum of fiscal responsibilities. This flexibility allows the Commission to contribute to a wide range of financial stability and governance issues.

Qualifications for Finance Commission Members

Article 280(2) and Section 3 of the Finance Commission (Miscellaneous Provisions) Act, 1951

The qualifications for the members of the Finance Commission are specified to ensure that the appointed individuals have a profound understanding and experience in public affairs, law, government finances, administration, and economics. This diverse expertise is crucial for the comprehensive assessment and recommendations the Commission is tasked with.

Procedures and Powers of the Finance Commission

Section 8 of the Finance Commission (Miscellaneous Provisions) Act, 1951

The Finance Commission operates with powers akin to those of a civil court, including summoning witnesses and requisitioning public records. This authority is essential for the Commission to perform its functions effectively, ensuring transparency and accountability in its proceedings.

Changes in Article 280 due to Constitutional Amendments

The inclusion of Article 280 (3)(bb) and Article 280 (3)(c) following these constitutional amendments expanded the Finance Commission’s responsibilities. Now, it also focuses on enhancing the financial states of Panchayats and Municipalities, reflecting the growing importance of local governance in India’s developmental narrative.

Members of the 16th Finance Commission

The 16th Finance Commission, led by Chairman Shri Arvind Panagariya, with members Shri Ajay Narayan Jha, Smt. Annie George Mathew, Dr. Niranjan Rajadhyaksha, and Dr. Soumya Kanti Ghosh bring together a team with diverse expertise in public policy, finance, and economics. Their collective knowledge and experience are instrumental in addressing the complex fiscal challenges faced by India.

Conclusion

In the intricate dance of fiscal federalism that defines the relationship between India’s Union and its States, the Finance Commission plays a pivotal role. As the 16th Finance Commission, under the able stewardship of Shri Arvind Panagariya, embarks on its journey, the eyes of the nation, and particularly those of judiciary aspirants, are keenly watching. This Commission, much like its predecessors, is not just about crunching numbers; it’s about ensuring equitable distribution of financial resources across the vast and varied landscape of India, keeping in mind the principles of justice, equity, and efficiency.

For judiciary aspirants, understanding the workings of the Finance Commission is not just about adding another feather to their academic cap; it’s about comprehending the very fabric of India’s fiscal federalism and the constitutional safeguards that ensure every state’s right to an equitable share in the nation’s prosperity. As we await the recommendations of the 16th Finance Commission, let’s remember that, at its core, this exercise is about reinforcing the spirit of cooperative federalism and ensuring that India’s growth story is inclusive, leaving no state behind. This understanding is crucial for those aspiring to be part of India’s judiciary, as they will one day be interpreting and enforcing these very principles, ensuring justice and equity for all.